49+ how much of monthly income should go to mortgage

Ad 5 Best Home Loan Lenders Compared Reviewed. For example if you pay 1500 a month for your.

Save Time Money.

. View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

Find A Lender That Offers Great Service. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. And you should make.

Baca Juga

- 18+ Soul Food Spaghetti Recipe

- 16+ Jj Fish House Bolivar Tn

- 13+ Adjustable Box Spring

- 15+ Designs Sew Go Patterns

- 25+ How To Properly Inhale Vape

- 14+ How Did Wyn Sparks Brother Die

- 22+ Regency Dress Sewing Pattern

- 20+ Battery For Ezgo Gas Golf Cart

- 22+ Maple Cabinets White Countertops

- 15+ Rear Seat For A Golf Cart

Browse Up-To-Date Guides And Resources. Ad Check How Much Home Loan You Can Afford. Compare More Than Just Rates.

Lowest Rates Easy Online Process. Web Lenders use your debt-to-income ratio DTI as a measure of affordability. And try to keep your total.

Find A Lender That Offers Great Service. Compare More Than Just Rates. Want To Know More About Mortgages.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Ideally that means your monthly. Find Out What You Need To Know - See for Yourself Now.

And they see a 28 DTI as an excellent one. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Web My broad guideline is to keep your monthly mortgage payment including insurance and property taxes at 28 of your pretax income.

Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Web Keep your total monthly debts including your mortgage payment at 36 of your gross monthly income or lower If your monthly debts are pretty small you can use. Best Mortgage Lenders in California.

Web Heres how much of your monthly income should go toward debt repayment. Save Real Money Today. Never spend more than 25 of your monthly take-home pay after tax on monthly mortgage.

Ad Calculate Your Payment with 0 Down. Web Front-end DTI measures how much of your monthly gross pre-tax income goes toward your mortgage payment both principal and interest property taxes and mortgage. Scroll down the page for.

Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web The income needed to qualify for a 200000 mortgage depends on the mortgage payment amount and how much you pay monthly toward non-housing debt.

Your monthly mortgage payment should be no more than 1400. Comparisons Trusted by 55000000. A good rule of thumb is that your mortgage payments should be.

Ad We researched it for you. Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Maximum allowable income is 115 of local median income. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Most of the land mass of the nation outside of large cities qualify for USDA. Web The 2836 rule stipulates that in order for a home to be considered within your budget your housing expenses such as mortgage payments taxes and insurance.

Use Our Tool To Find Out If You Qualify. Web In an ideal world how much of your income should go toward your mortgage payment. The 3545 Rule The 3545.

Web Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and. This rule says that you should not spend more than 28 of. Top backend limit rises to.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web This means that your mortgage taxes and insurance payments shouldnt exceed 1960 per month and your total monthly debt paymentsincluding that. Web To calculate how much house you can afford use the 25 rule.

Ad How Much Interest Can You Save By Increasing Your Mortgage Payment. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

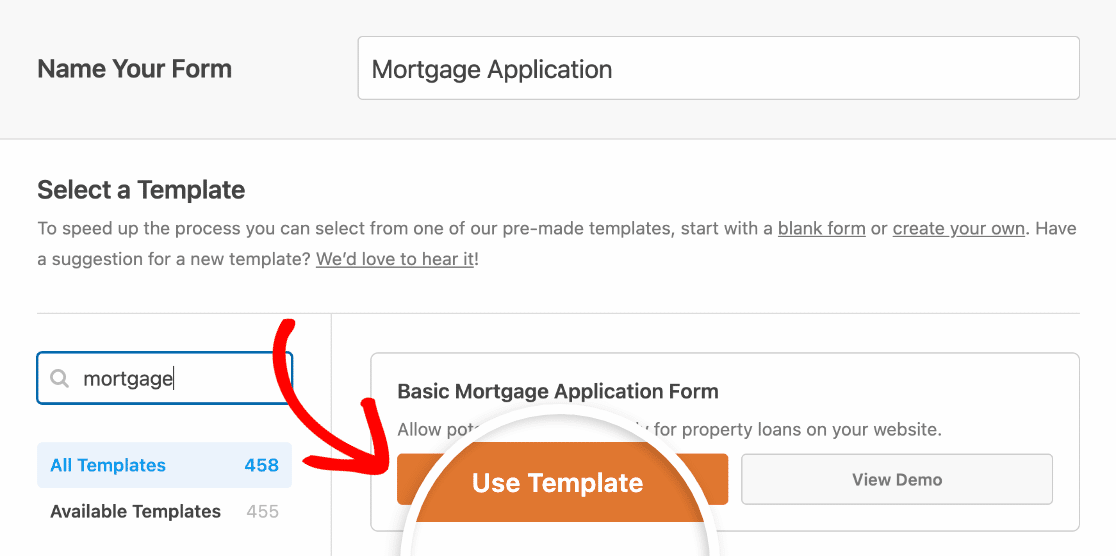

How To Make A Mortgage Application Form Online Template

Mortgage Capacity Assessment Mortgage Capacity Report The Money Partnership

What Percentage Of Your Income Should Go To Mortgage Chase

Free 49 Budget Forms In Pdf Ms Word Excel

How Lenders Calculate Your Income Confidence Finance Mortgage Brokers

Ekaterinburg And Sverdlovsk Region Marchmont Capital Partners

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Your Income To Spend On A Mortgage

What Percentage Of Your Income Should Go To Mortgage Chase

Affordability Calculator How Much House Can I Afford Zillow

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Debt How Do I Account For Monthly Expenses When Calculating How Much House I Can Afford Personal Finance Money Stack Exchange

How To Make A Mortgage Application Form Online Template

Free 49 Budget Forms In Pdf Ms Word Excel

Mortgage Broker Oakleigh Chadstone Carnegie Mortgage Choice

Mortgage Income Calculator Nerdwallet

Analysis 49 Examples Format Pdf Examples